-

Trip Cancellation & Interruption

Get reimbursed for non-refundable costs when plans change unexpectedly. -

Delays & Missed Connections

Coverage for meals, hotels, and rebooking when flights don’t go as planned. -

Emergency Medical & Evacuation

Up to $500,000 for accidents, illness, and transport to proper care. -

Family & Group Coverage

Protect up to 10 travelers under one plan. -

Extra Protection Options

Add Cancel For Any Reason (CFAR) for maximum flexibility. -

Easy Integration

Using our unique URLs and tools for promoting VisitorsCoverage.

What Does Cruise Insurance Cover?

Mandatory Insurance

Some cruise lines won’t let you board without proof of insurance. Having coverage ensures you meet requirements and avoid last-minute surprises.

Trip Cancellation

Cruises are a major investment. This coverage helps you get your money back if you have to cancel for a covered reason—so you don’t lose thousands of dollars.

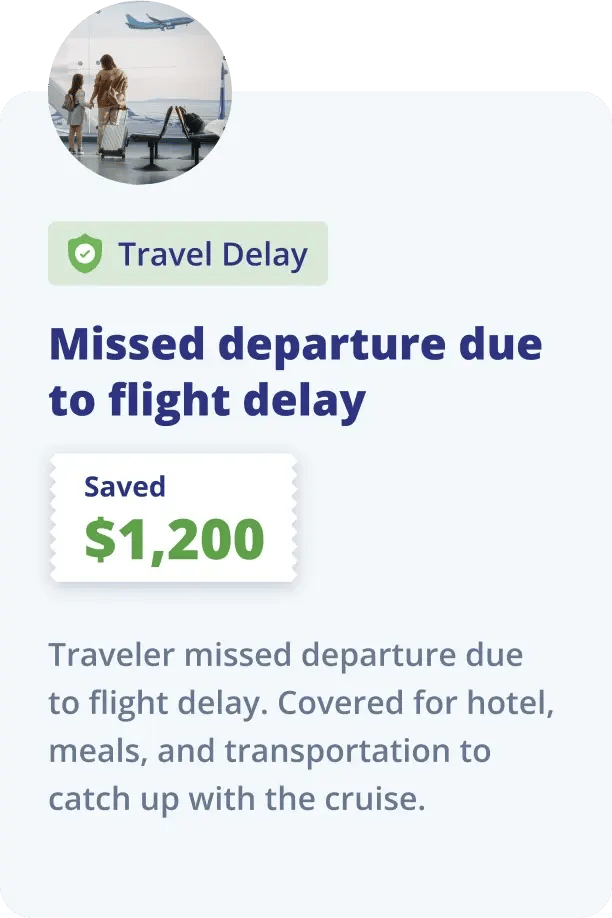

Trip Delay

Covers meals, lodging, and transport if delays leave you stuck, so unexpected setbacks don’t drain your wallet.

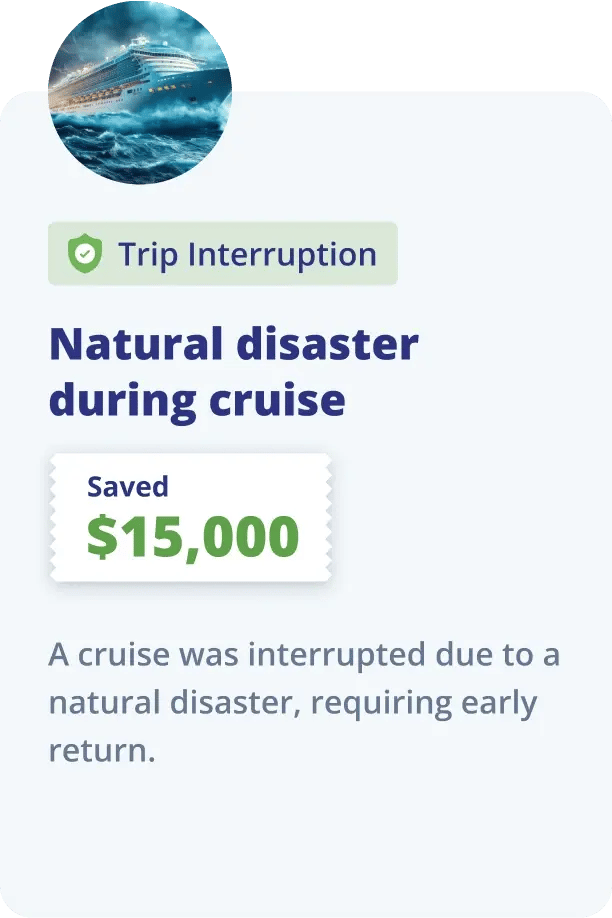

Trip Interruption

If an emergency forces you to cut your trip short, this coverage reimburses your unused trip costs and pays for getting you home quickly.

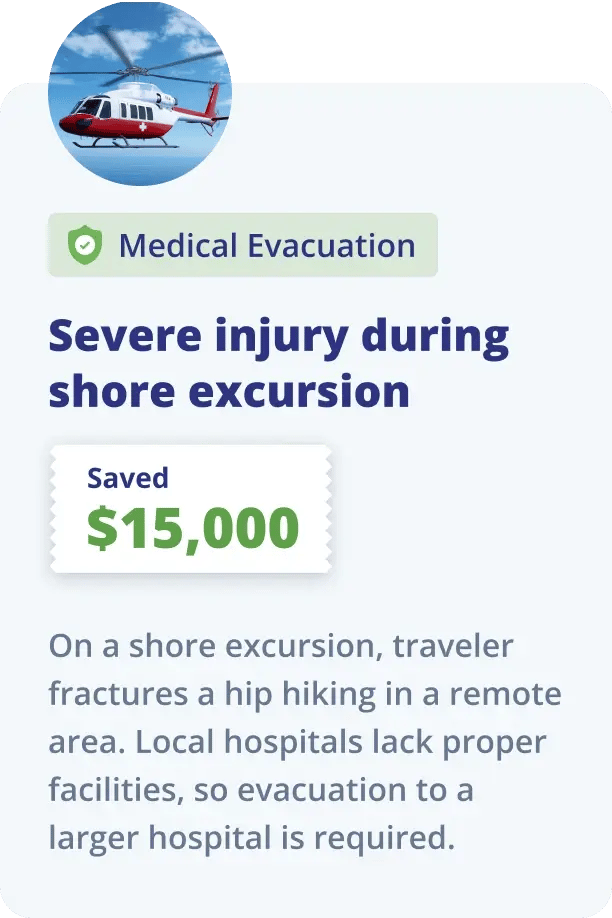

Medical Evacuation

Emergency evacuations can cost tens of thousands of dollars. This coverage gets you to the nearest hospital or back home without the financial burden.

Delays & Missed Connections

Missing the ship can be expensive. This protection pays for last-minute travel arrangements so you can catch up with your cruise.

Medical Emergencies

Medical care at sea or abroad can be costly and is often not covered by your regular health insurance. This coverage ensures you get treatment without a massive bill.

Baggage & Belongings

Lost or delayed luggage can ruin your trip. This coverage reimburses you for essentials so you can keep enjoying your vacation.

Here’s why many travelers prefer VisitorsCoverage plans

Better Value

Cruise-line insurance are generally more expensive and offer less coverage, while VisitorsCoverage plans give you more flexibility and protection.

Broader Coverage

VisitorsCoverage plans protect your entire trip—including flights, hotels, and excursions after the cruise—not just the period before or during it.

Higher Medical Limits

VisitorsCoverage plans usually offer stronger medical and evacuation coverage.

More Cancellation Options

Cruise-line coverage may only offer future cruise credits, while VisitorsCoverage provides cash refunds and Cancel For Any Reason (CFAR) options.

Simpler Claims

VisitorsCoverage provides claims assistance right here in the U.S., making it easier and faster to get reimbursed.

As Seen In:

Cruise line insurance vs. VisitorsCoverage

Most cruise lines require insurance. See how our cruise plans offer better value.

Saved $4,600

Saved $1,400

Saved $900

Saved $5,200

How you can save money on unexpected cruise travel events*

Join thousands of travelers who have saved money with travel insurance.

Saved $4,600

Saved $1,400

Saved $900

Saved $5,200

Cruise Insurance FAQs

Everything you need to know before you set sail.

Is cruise insurance mandatory?

Some cruise lines won’t let you board without proof of insurance. Having coverage ensures you meet requirements and avoid last-minute surprises.

I already booked my cruise. Is it too late to buy cruise insurance?

No—you can still buy cruise insurance. However, the earlier you purchase, the more comprehensive your coverage will be, especially for trip cancellation and pre-existing medical conditions.

I have credit cards and health insurance that should cover me. Why should I get cruise insurance?

While credit cards and health insurance offer some protection, cruise insurance provides broader, cruise-specific coverage that they usually don’t, including:

- Trip cancellation/interruption: Credit cards may cover some cancellations, but only under limited circumstances. Cruise insurance reimburses many covered reasons, like illness, family emergencies, or travel delays.

- Medical emergencies on the cruise: Health insurance may not cover treatment onboard or emergency evacuation to another country or back home. Cruise insurance fills this gap.

- Lost, stolen, or delayed baggage: Cruise insurance reimburses essentials if your luggage is lost or delayed, which credit cards may not fully cover.

Can cruise insurance cover pre-existing medical conditions?

Yes. Many plans offer coverage if purchased within a set period after your cruise booking. Always review policy details for eligibility.

Can I get a refund if I decide not to go on my cruise or something unexpected comes up?

Standard cruise insurance reimburses cancellations only for covered reasons (illness, injury, family emergency). If you purchase Cancel For Any Reason (CFAR) coverage, you can cancel for almost any reason and receive reimbursement for up to 75% of your prepaid cruise costs.

What happens if one of the travelers under my insurance cannot go, but I still want to?

If a travel companion cancels for a covered reason, their portion of the trip cost is usually reimbursed. Your coverage remains valid, and some plans may cover the added “single supplement” cost if you travel alone. Certain policies may also allow you to cancel your trip if your insured companion cancels.

Will my regular health insurance cover me on a cruise?

Often not. U.S. health insurance may have limited or no coverage abroad, making cruise insurance essential for overseas protection.

How easy is filing a claim, buying, or canceling insurance?

Filing a claim is quick and hassle-free, online or by phone, with guidance from VisitorsCoverage. Most plans can be purchased after booking (with some time-sensitive rules for pre-existing conditions). Plans usually include a free look period (10–14 days) to cancel for a full refund if you haven’t started your trip or filed a claim.

Why CHOOSE VisitorsCoverage?

Over 19 Years

of Innovation & Excellence

-

Trusted by 1 million+ travelers

-

Award-winning US-based licensed insurance specialists are here to help

-

24/7 personalized support with our AI Assistant

-

Flexible plan options, including Cancel For Any Reason (CFAR) and other add-ons

As Seen In:

Our Happy Customer Experiences Say It All

Disclaimer: Plan features listed here are high level, provided for your convenience and information purpose only. Please review the Evidence of Coverage and Plan Contract (Policy) for a detailed description of Coverage Benefits, Limitations and Exclusions. Must read the Policy Brochure and Plan Details for complete and accurate details. Only the Terms and Conditions of Coverage Benefits listed in the policy are binding.

*Pricing may vary depending on a variety of factors such as number of travelers, age, duration, and more. Pricing and plan features listed here are high level, provided for your convenience and information purpose only. Please review the plan documents for a detailed description of Coverage Benefits, Limitations and Exclusions.

*For privacy purposes, all specific names and identifying details for claims scenarios have been replaced with generic placeholders to ensure confidentiality.