Protect Your Trip with Travel Insurance

What's The Trip For?

-

Trip Cancellation & Interruption

Get reimbursed for non-refundable costs when plans change unexpectedly. -

Delays & Missed Connections

Coverage for meals, hotels, and rebooking when flights don’t go as planned. -

Emergency Medical & Evacuation

Up to $500,000 for accidents, illness, and transport to proper care. -

Family & Group Coverage

Protect up to 10 travelers under one plan. -

Extra Protection Options

Add Cancel For Any Reason (CFAR) for maximum flexibility. -

Easy Integration

Using our unique URLs and tools for promoting VisitorsCoverage.

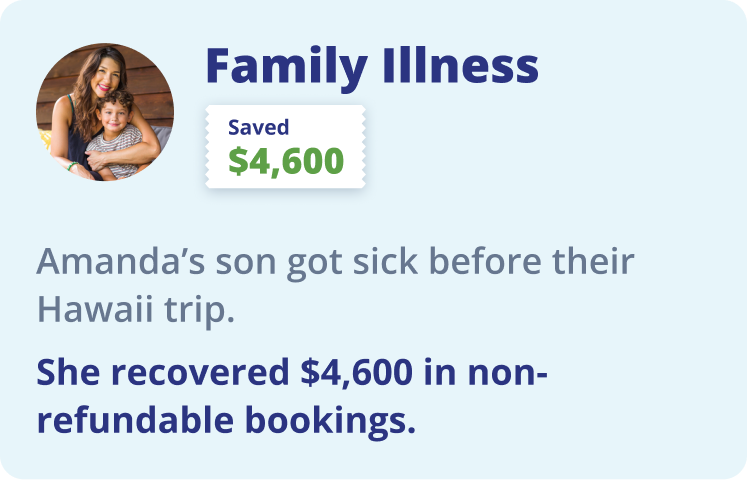

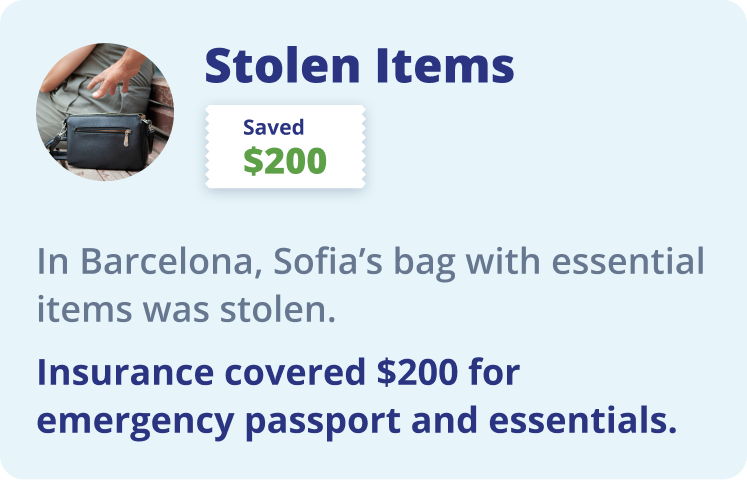

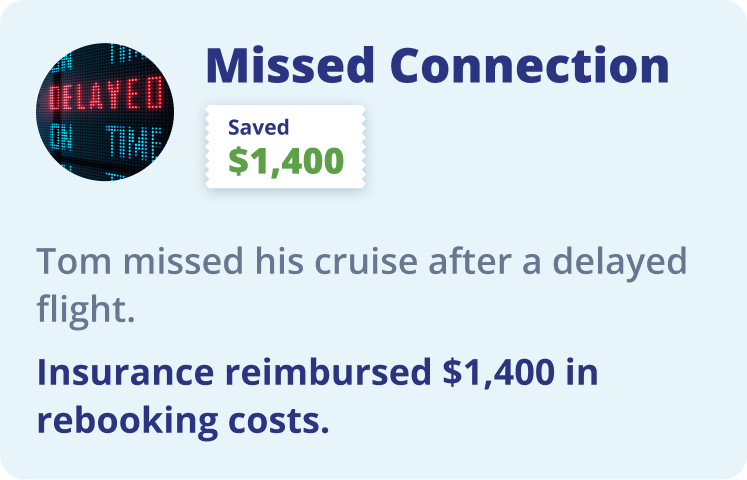

Save Money on Unexpected Travel Events

Join thousands of travelers who have saved money with travel insurance.

Saved $4,600

Saved $1,400

Saved $900

Saved $5,200

Popular Benefits

Trip Cancellation & Interruption

Get reimbursed for non-refundable costs when plans change unexpectedly.

Delays & Missed Connections

Coverage for meals, hotels, and rebooking when flights don’t go as planned.

Emergency Medical & Evacuation

Up to $500,000 for accidents, illness, and transport to proper care.

Family & Group Coverage

Protect up to 10 travelers under one plan.

Add Extra Protection Options

Add Cancel For Any Reason (CFAR) for maximum flexibility.

Why CHOOSE VisitorsCoverage?

Over 19 Years

of Innovation & Excellence

-

Trusted by 1 million+ travelers

-

24/7 customer assistance

-

Flexible plan options, including Cancel For Any Reason (CFAR) and other add-ons

As Seen In:

Our Happy Customer Experiences Say It All

Disclaimer: Plan features listed here are high level, provided for your convenience and information purpose only. Please review the Evidence of Coverage and Plan Contract (Policy) for a detailed description of Coverage Benefits, Limitations and Exclusions. Must read the Policy Brochure and Plan Details for complete and accurate details. Only the Terms and Conditions of Coverage Benefits listed in the policy are binding.

*For privacy purposes, all specific names and identifying details for claims scenarios have been replaced with generic placeholders to ensure confidentiality.